As the world population grows, so does the demand for protein. Plant-based protein is seeing particularly high growth potential, and Canada is in a good position to become a leading supplier of the plant-based foods and ingredients the world is looking for.

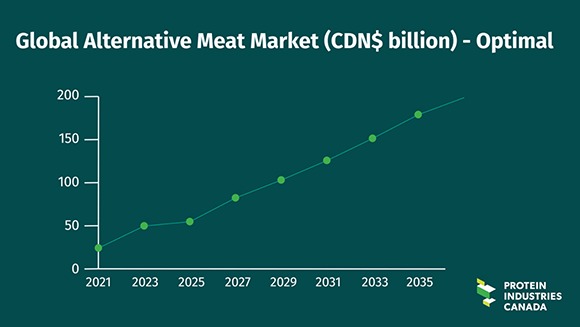

Protein Industries Canada recently commissioned a report from Ernst and Young to assess the global plant-based foods market over the next 15 years, along with Canada’s potential share of this market. According to this report, the global market is expected to reach $250 billion by 2035, with meat alternatives expected to be up to $180 billion of that total. Protein Industries Canada’s CEO Bill Greuel predicts Canada can supply approximately 10 per cent of that total—leading to more jobs, a strengthened economy, and new plant-based foods and beverages for consumers around the world.

The goal may sound ambitious, but Canada’s ability to meet it comes down to several factors. One of the most prominent is our diverse crop selection, which is made even more important by what Ernst and Young predicts will be the crop mix making up the plant-based protein ingredient supply in 2035.

“It looks very promising for the crops that we produce at scale here in Canada,” Greuel said. “Consumers want choice, and these diverse sets of plant-based ingredients that we can create from the crops we produce in Canada give that choice.”

Peas, lentils and other pulses will all significantly rise in demand. This is good for Canadian innovation, and will help Canada build on its already strong reputation. Our strong food safety system, sustainable production and processing practices, market access, and strong skills, talent and research clusters only help to reinforce this reputation while bringing us closer to our 2035 goals.

There’s more work to do, however. The United States, the Netherlands, Singapore and China are considered some of Canada’s top competitors in the plant-based foods space, for varying distinct reasons. While Canada’s plant-based food and ingredients sector is growing at a rate comparable to theirs, important steps are needed to ensure we keep pace.

This includes improving the sector’s access to capital.

“Our best estimate is we have to increase crop processing capacity in Canada by almost 6 million metric tonnes,” Greuel said. “The capital required to do that is measured in the billions, not the millions. So we really need to educate the venture capital community, we need to incent patient capital into the market, and we need to create opportunities for innovative processing and food manufacturing companies to talk directly to the capital community.”

Other steps named by each Greuel and the Ernst and Young Report include the following:

- Implementing diversified strategies;

- Advancing processing capabilities;

- Enabling ingredient manufacturing and formulation;

- Improving branding and showcasing Canada’s competitive positioning; and

- Facilitating regulatory modernization and improving interjurisdictional coordination and collaboration.

Canada has the potential to be a leader in the supply of plant-based food, feed and ingredients. By taking the appropriate steps and building on our already strong reputation as a commodity supplier, we can meet our goal of capturing 10 per cent of the global market by 2035—or making one in every 10 plant-based meals Canadian.